Since 1909, when we were founded as a rural bank, we have grown into a modern customer-centric banking Group. We are proud to be a proximity bank, where the relationship with the customer is an essential value. We keep direct and constant relationships with our customers in our branches and through new digital chan-nels.

To us, being a bank means driving the development of the local communities. We support families and busi-ness concerns with flexible and expert services while maintaining a strong local connection. We pay particu-lar attention to SMEs, recognising their crucial role in the economy.

By blending our long history with a relentless focus on innovation, we continuously enhance our services to of-fer a digital banking experience that upholds the essence of traditional banking. Our commercial and techno-logical evolution allows us to ensure the provision of quality, timely, and efficient service.

The soundness of our history and our confidence in our role allow us to grow steadily as a solid and inde-pendent group.

The steps of our journey

-

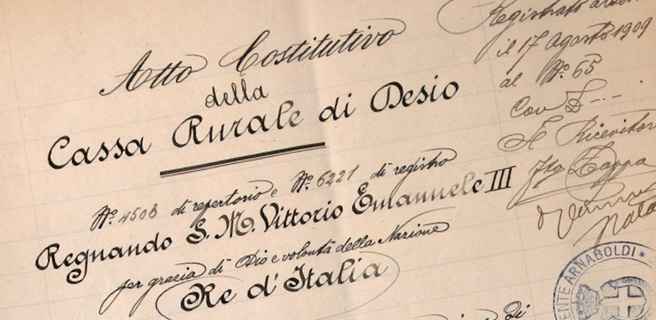

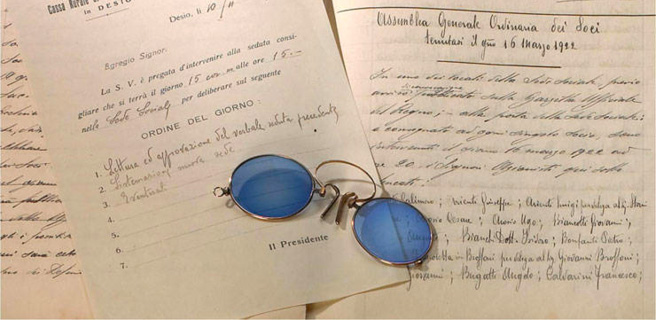

1909

Cassa Rurale was founded by local landowners, professionals, and entrepreneurs led by Mr Egidio Gavazzi.

-

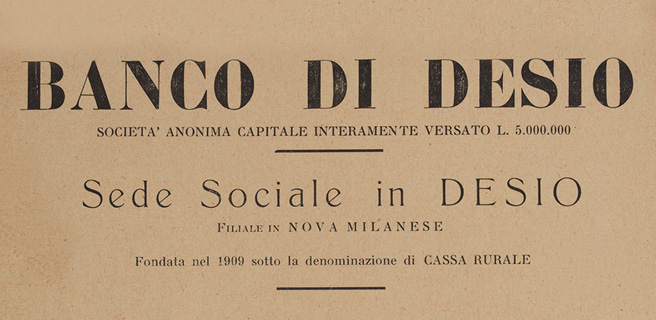

1925

The bank changed its name to Banco Desio and opened its first branch in Nova Milanese.

-

1967

Merged by incorporation with Banca della Brianza

-

1978

Banco Desio opened its first branch in Milan, Piazza Affari.

-

1986

Banco Desio opened its first branch in Milan, Piazza Affari.

-

1995

Banco Desio was listed on the Milan Stock Exchange.

-

1999

Banco Desio took control of the asset management company Anima.

-

2007

Fides SpA, a company specialising in salary-related loans, became part of the Banco Desio Group.

-

2009

Banco Desio celebrated its first centenary

-

2014

Banca Popolare di Spoleto joined the Banco Desio Group.

-

2022

Banco Desio signed an agreement with the BPER Group to acquire 48 branches, strengthening its territorial and customer network.

-

2022

Banco Desio signed a strategic agreement with Worldline Italia on Monetica/Acquiring, transferring the merchant acquiring business and entering into a contract for distributing Worldline’s services through its own network.

-

2023

Banco Desio concluded the acquisition of 48 branches from the BPER Group, including bank branch-es in Liguria, Emilia Romagna, Latium, Tuscany and Sardinia..

-

2024

Banco Desio strengthened its presence in the salary-backed loan market by acquiring a stake in Dynamica Retail S.p.A share capital.

-

2024

Banco Desio signed an agreement with Banca Popolare di Puglia e Basilicata to acquire 14 bran-ches in Latium, Lombardy, Veneto, Marche and Piedmont.